The evolution of impact investing

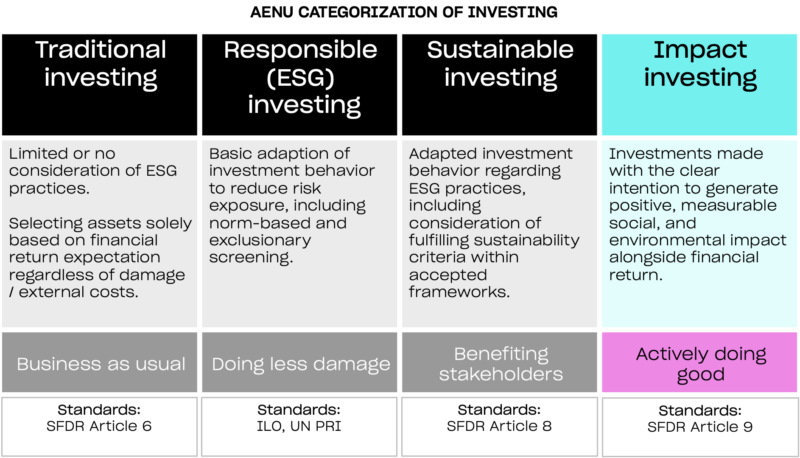

For some, impact investing may be a completely new terminology. Others may assume impact investing relates to sustainability or ESG. We are here to clarify exactly what we mean by impact investing and how it differs to other types of investing, specifically in relation to the venture capital asset class.

Traditional investing

Most of us are familiar with this investing type. Ironically, we believe it is the one that has run its course and won’t be around for much longer. The concept of traditional investing in venture capital refers to investors financing a new or growing business, driven solely by financial returns. Investments are made regardless of their environmental or social impact.

Responsible investing

Responsible investing arguably dates back to 1960, when investors excluded stocks and industries from their portfolios such as tobacco or involvement with the Vietnam war. However, it accelerated when Environmental, Social and Governance standards (ESG) made its first significant appearance, through a 2006 United Nations Principles for Investment report. It was then, for the first time, ESG was incorporated in the financial evaluations of companies. Investments were now accountable to meet the regulatory ESG requirements. It was a step in the right direction, but essentially was the bare minimum.

There have been many ESG frameworks introduced since, including the SASB framework in 2018 and the GRI framework in 2000. These are the most widely used frameworks and they are continuously developed. More recently, in 2020, the World Economic Forum (WEF), the International Business Council (IBC) and the Big Four accounting firms (Deloitte, PwC , KPMG, and Ernst & Young) began to accelerate ESG transformation. They developed a framework of 21 metrics for companies to report, benchmark and easily compare their ESG results. It was designed to demonstrate contributions to the United Nations Sustainable Development goals (SDGs), which were established five years earlier.

ESG Frameworks continue to face challenges around data accessibility, consistency and transparency. As a result, investors struggle to incorporate and implement ESG. Interestingly, however, a recent study published in Harvard Law School Forum on Corporate Governance, found that 61% of investors view ESG as a permanent and pre-eminent part of the investment landscape, despite the warranted scepticism around the value of ESG. We would agree with the view that ESG is considered as compliance for most investors because they do what is legally required. Generally, ESG needs more development. As Mark Goyder from Tomorrow’s company put it, the Big Four’s approach to ESG can be viewed as a reactive approach rather than a proactive approach. Another fundamental issue is when companies too often over amplify their ESG data as a marketing tool. This is where the term “greenwashing” comes from.

Let’s move onto more proactive approaches.

Sustainable investing

Investors have increasingly developed their portfolios to benefit all stakeholders, going beyond the box-ticking ESG exercise. Sustainable investing aims to generate positive effects on people and the planet, as well as financial outperformance. The B Impact Assessment created by B Lab, is one of the best examples of a sustainable framework. The assessment contains 200 questions in total and once verified and completed, a company receives a B Corp Certification. A certified B Corp is a for-profit business that is “legally required to consider the impact of their decisions on their workers, customers, suppliers, community, and the environment” (check out our blog on why you should build or invest in a B Corp).

Impact investing

To differentiate impact investing from the other types, it’s helpful to understand the differences between Articles 8 and 9. These are classifications of investment strategies under the EU’s Sustainable Finance Disclosure Regulation (SFDR), which requires investors to reveal their strategy’s level of sustainability focus. Responsible and sustainable investing relate to Article 8, which is environmental and socially promoting. Whereas impact investing relates to Article 9, known as products targeting sustainable investments, where “a financial product has sustainable investment as its objective and an index has been designated as a reference benchmark.”

Using the analogy of internal vs. external impact is also a good way of understanding what defines impact investing. Internal impact is usually the impact the company has on its direct stakeholders through its operations (ESG), and external impact is the specific impact that the company’s product or service is generating. Impact investing is solution-oriented.

How AENU defines impact

Within impact investing, different investors have different impact lenses and impact return profiles. AENU defines impact with our impact thresholds and impact guidelines. We only invest in technologies that have the potential to avoid or capture 100 Mt CO2 at scale, or the potential to reach at least 10 million people at scale / significant change outcomes for primary stakeholders. We have six impact guidelines to help us understand whether the potential impact meets our investment thresholds: Intentionality, Impact logic, Depth and Breadth, Interlock, Additionality and Impact Measurement. Let’s take a look at a few examples that AENU would not consider impact aligned:

A technology company that helps high-emitting industries decarbonize by reducing their carbon footprint in oil refinery and chemical production plans. You could say this is a ‘Reform vs. Transform’ scenario. And it does not align with our “Impact Logic” guidelines. This company focuses on “cleaning up” high emitting industries but for AENU, impact investing focuses on totally transitioning away from those industries. AENU particularly believes investing in renewables is better than investing in the decarbonization of oil and gas. A similar example could be a company who produces sustainable fishing lures. Although it would be a sustainability improvement in fishing equipment, AENU would rather support companies accelerating the transition away from fish to alternative (non-animal derived) proteins. We’ll take a final example of sustainable alternatives to household items such as inductive liquid heater kettles. Whilst they reduce energy waste and prevent non-recyclable electronic and plastic waste, the problem being solved is not big enough, as standard kettles use a very small amount of household energy. Thus, this would not align with our “Depth and Breath” guideline.

Last year, impact startups raised a record €39B in venture funding, surpassing the €16B raised in 2020. The opportunities will continue to increase. But we need more technology innovation, we need more impact investors, we need to make impact investing the new normal.

For more information on our approach to impact investing, download our impact framework here.