The alternative protein market under the microscope

Our team recently went out for dinner at a vegan restaurant in Berlin. As our mix of vegans, veggies and flexis ordered from the menu, I couldn’t help but marvel how far alternative proteins have come over the past ten years. We’ve written about alternative proteins before, but today I want to delve deeper into this intriguing market. How can we (as a society and as a VC), help alternative proteins reach their full potential? Grab a coffee and let’s begin.

WHY: The Impact of alternative proteins

Impact problem

The food sector accounts for an astounding 26% of GHG emissions worldwide. It also has an enormous impact on our natural ecosystems and biodiversity (read our Alternative Proteins 101 article to learn more). The key to overcoming this impact problem is behavioral change.

Although climate change is an existential risk, there is a psychological distance between people with high individual carbon footprint and climate disasters. In AENU’s home turf, Germany, heavy floods destroyed crops and livelihoods only last year. And yet, Germans remain among the top 10 CO2 emitters in the world. This behavioral conundrum is one of the hardest challenges we face, and one of utmost interest to AENU given our systemic change ambitions.

The IPCC has also identified behavioral change as the largest untapped potential in the fight against climate change. As Priyadarshi Shukla, Co-Chair of IPCC Working Group III put it: “Having the right policies, infrastructure and technology in place to enable changes to our lifestyles and behaviour can result in a 40-70% reduction in greenhouse gas emissions by 2050. This offers significant untapped potential.”

Our diets and our preconceptions about alternative proteins is a prime example of this untapped behavioral change. Let’s take a look at its significance.

Impact potential

According to the IPCC, there is an 8 Gt CO2e annual emissions reduction potential if everyone in the world would become vegan. 8 Gt is almost one fifth of the world’s annual emissions – huge! Beyond emissions, plant-based diets could reduce water consumption by up to 50%. A significant amount considering that experts predict a global water scarcity of a catastrophic scale if we continue to rely on meat and dairy. And for those who cherish wildlife, if we all made the switch to even a partly plant-based diet, we could save 500 species from extinction.

I have not been able to become vegan. Like many, I have repeatedly failed at giving up on dairy and eggs (I do love cheese!). At AENU, we take a middle case scenario: we believe that inducing people to become at least flexitarians has enough climate mitigation potential while being a more feasible and tangible goal.

And it’s not just us: many consumers, food corporations, and policy-makers agree that animals are here to stay. Some even claim that farmed animals are essential to maintain our precious biodiversity and ecosystems alive and healthy. I agree that there is also impact to be made within the animal value chain: reducing methane emissions from livestock enteric fermentation process, for example.

At AENU, we decided not to invest in technologies that are linked to the animal value chain for two reasons: (1) although we agree animals are here to stay and even necessary to feed a growing population, we don’t want to contribute to the growth of the livestock sector – other investors can do that – and (2) we decided to become a vegetarian company, that is, we don’t buy or reimburse any meat or fish meals. This is our little internal nudge to advance the necessary behavioral change, at least at home.

Impact at the technology level

When it comes to the ‘why’ of alternative proteins, for us it’s very simple: it matches the impact we are looking for through our investments. First, it matches our impact goals (emissions reduction, biodiversity conservation and water usage reduction). Second, it matches our impact investment thresholds (you can read more about these here). Even when adjusting for the projected penetration rate of alternative proteins in the next 10 years, the climate impact potential of alternative proteins is north of 800 Mt CO2e, well above our 100 Mt CO2e threshold.

However, different alternative protein technologies (from symbio platforms to cellular agriculture) will have different impact / commercial trade-offs, and our impact team analyzes these at the company level from a bottom up approach. Substantial innovations in alternative proteins have only come to surface fairly recently. It is these technologies that excite us the most. However, it is interesting to look back on the evolution of alternative proteins and see where they come from.

WHY NOW: Alt protein history

Alt protein market overview

Many think that the start of the alternative protein industry came with Beyond Meat (the company was founded in 2009), but in reality we have been eating plant-based products for a little bit longer than that. In 1985, Quorn commercialized the first available vegetarian burger made from rice, vegetables and cheese. It has been a long journey since. In 2013, the first cultured meat burger made from cow cells was developed in the Netherlands, at a price that only a handful of people around the world could afford – $330,000.

The alternative protein market is now valued at $2.2B. Compared to the $1.7T the traditional meat market is worth, there is a long way to create a large commercial and environmental impact. When looking at the growth rate of global meat consumption over the next decade (14% by 2030), the picture becomes even less rosy. This trend is partly driven by population growth in low income countries. High income countries show a different consumption pattern – a reduction of meat consumption per capita – marked by changing preferences, aging and slower population growth.

On top of the hypergrowth of meat consumption, there has been criticism around the undue hype of alternative proteins. The media calls it the death of plant-based meat: this piece by our Next Gen Foods co-investor Michael Klar summarizes what’s happening in the plant-based market backed by data.

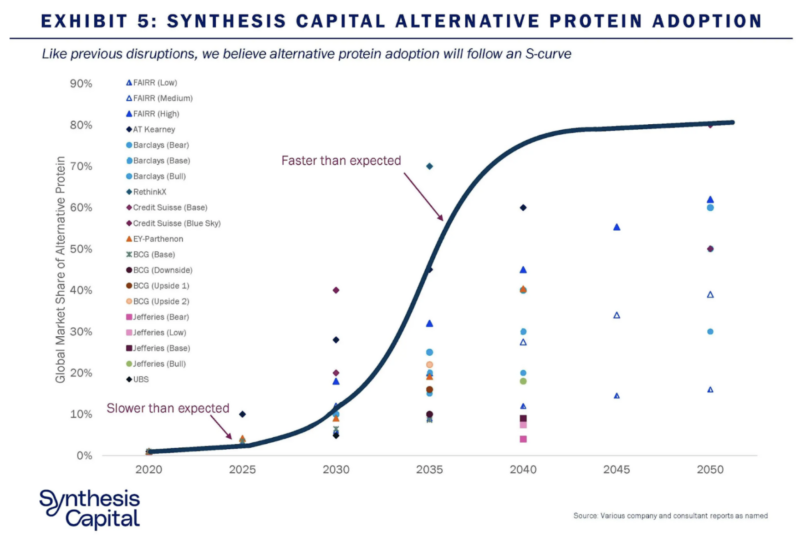

At AENU, we think this oversimplifies the true potential of one of the most powerful climate technologies. We are still consuming very similar plant-based products as +10 years ago. The rate of innovation in plant-based products is only picking up steam now with a new generation of ingredients powered by novel technologies (at least in the Food sector) like precision fermentation or synthetic biology. As Synthesis Capital explains in this article, we are at the bottom of the S technological curve.

Although there are different takes on the growth of the alternative protein industry over the next +10 years – we believe that the penetration rate of alternative proteins will be between 5 and 10% by 2030 and that we haven’t reached the tipping point.

Growth drivers

To come closer to such a tipping point, the industry needs to focus on the long-term and short-term growth drivers for alternative proteins.

In the short term, we see two key supply drivers that have pushed consumption but also investments in alternative proteins to new heights:

- COVID-19 has changed the way people select, pay for and collect food. The pandemic accelerated the consumption of plant-based proteins – a positive behavioral push to more conscious diets.

- Supply chain disruptions, although connected to COVID, have emerged as a large concern across industries, which has affected both top and bottom lines. Ensuring supply chains are resilient to shocks is now a business priority.

In the long-term, there are two more notable demand drivers:

- Consumer preferences: Whether it’s health, environmental or animal welfare concerns, there is no doubt that consumer attitudes toward animal-derived diets are changing rapidly in high income countries, especially among younger generations.

- Regulation: Although the animal industry is heavily subsidized by governments all around the world, climate regulation will inevitably open conversations about existing agricultural frameworks and incentive realignment with climate goals.

Given the above supply and demand drivers, the alternative protein industry has plenty of potential to grow. A few critical factors we are keeping an eye on: repeat purchases, average recurring purchase per consumer, and penetration rate of alternative proteins in emerging and low income countries.

Investments in alt proteins

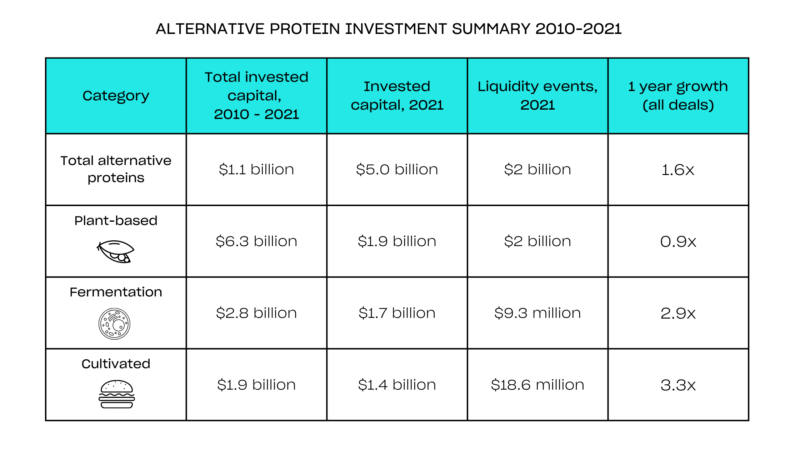

In 2021 alone, the investment growth in alternative protein was almost as high as in the last 10 years. Plant-based proteins have dominated the fundraising race. What’s interesting is, in the past 10 years, 30% of the capital invested in plant-based was invested in 2021 ($1.9B) compared to 60% in fermentation and 73% in cultivated. The latter two markets have only started to gain traction in recent years. As investors focus on upgrading recipes and textures to drive higher consumer adoption of alternative proteins, fermentation and cultivated technologies will continue to see strong investment growth.

From a macro perspective, the 2022 investment slowdown in venture capital has also affected alternative proteins. According to the Good Food Institute, during Q2 2022 alternative protein companies raised $833 million, compared to $914 million in Q1 — a 9% decline. This compares to a 26% decline quarter over quarter in the general VC market.

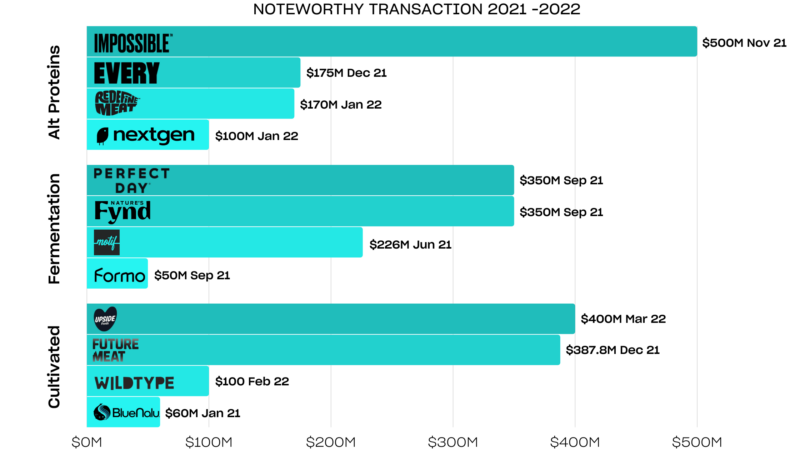

Below is a snapshot of some of the largest alternative protein investments in 2021 and 2022:

Corporates are coming

Beyond venture capital investors, we have noticed more and more corporates jumping on the alternative protein boat recently. Food corporations specifically have been upping their game when it comes to partnerships, joint ventures, buyers and even investors. A few recent examples include:

- In August 2022, Fonterra and Royal DSM launched a joint venture that commercializes fermentation-derived proteins with dairy-like properties

- In September 2022, Puratos, bakery food ingredients company, partnered with Shiruto accelerate plant-based bakery food innovation

- In April 2022, Givaudan, Tyson and Cargill invested in Upside Foods in their Series C funding

My favorite example is Rügenwalder Mühle (and not just because I love their products!): in 2014, they decided to enter the alternative protein market, and in 2021 they already earned more revenue from plant-based products than from animal-derived products.

WHO: The technologies and the startups

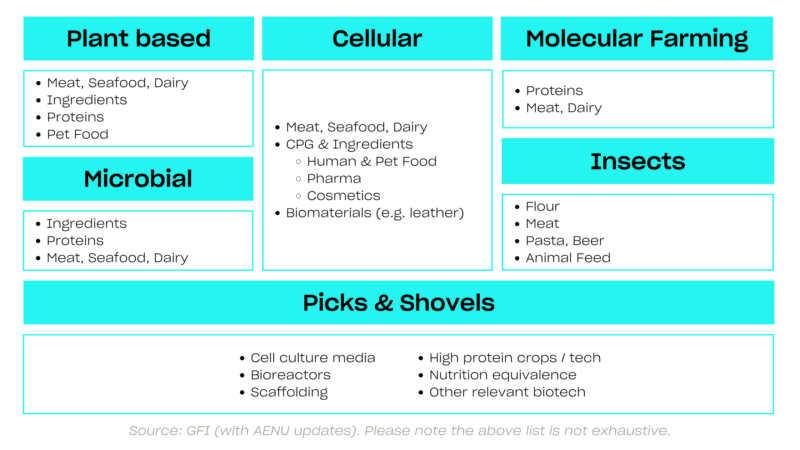

The alternative protein product mix can be categorized into five technology clusters:

- Plant-based proteins are the most well established and are derived from protein-rich seeds through dry or wet fractionation. The most popular type for consumers is soy, followed by pea, and is used in all product categories, from salmon filets to mozzarella cheese. The first generation of plant-based products (e.g. Beyond Meat) has been followed by companies focusing on upgrading textures (e.g. Tender Foods). The startups we are keeping an eye on are Next Gen Foods (AENU portfolio company) and Project Eaden.

- Fermentation uses microorganisms to produce specific ingredients like proteins. The process can be fuelled by raw materials like waste, CO2, or traditional media. There are different fermentation processes used by alternative protein companies: traditional, biomass and precision fermentation. We are keeping an eye on Formo and Shiru.

- Cultivated or cellular technology cultivates animal cells directly and arranges them in similar structures as animal tissues. We are particularly excited about Upside Foods and Future Meat.

- Molecular farming takes plants and uses them as mini-factories to produce proteins that are normally only found in non-native proteins including animal proteins. It aims to produce recombinant proteins in a safe and inexpensive way. Nobell Foods is a key player to watch in this category.

- Picks & shovels – or infrastructure plays – like cell culture media (liquid or gels that support cellular growth in an artificial environment), bioreactors (equipment for growing organisms such as yeast, bacteria, or animal cells under controlled conditions) and scaffolding (which binds proteins). Startups worth watching in this category are Mooji Meats and Novameat.

All five technology clusters will continue to play an important role in the transition to a flexitarian world. However, some are more VC-investible than others. To identify such areas, AENU derives specific criteria which we discuss in the following section.

HOW

Our thesis: the parity challenge

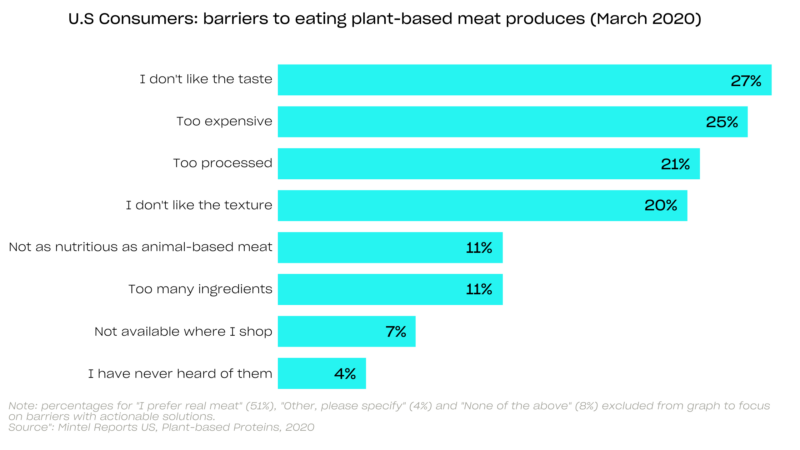

The biggest impact lever in the food sector is moving towards a fully plant-based, or at least flexitarian diet. This can only be achieved by substituting animal products for alternative proteins. To seize the full potential of alternative proteins, sustainable protein options have to overcome the consumer parity challenge of health, taste and affordability. The shift toward a fully plant-based or flexitarian diet will require cost- and impact-effective alternative proteins. Input (ingredients, taste) and process efficiency gains are necessary to scale plant-based and microbial solutions.

High level criteria on what we are looking for

At AENU we scout climate-tech and social impact founders aiming to disrupt industries to achieve a more sustainable and equal future. Within alternative proteins, we consider:

- White spaces: Meat, especially BC2 products, is already a red ocean of startups with little differentiation, and oftentimes only marginal technology superiority. We are more interested in the pockets that are underserved, like B2B functional ingredients or alternative cheese.

- (IP) defensibility: We like companies with high degrees of defensibility, particularly on the technology side. The IP has to be critical to the adoption of the product.

- Technological readiness level (TRL): As a climate investor, we cannot shy away from scientific breakthroughs with commercial opportunities. We can invest along the TLR 5 and above so long as the research and techno-economic analysis makes sense.

- Scalability: Biotech solutions like precision fermentation, cultured, or molecular farming, are much more difficult to scale. We get excited by models that take this scalability into account through novel partnerships, business models or technological levers.

- Long time to maturity: In addition to TRL and scalability, R&D cycles can be especially long for certain technologies, making them less attractive for short-term venture capital investors. Our evergreen structure allows us to experiment. However, the right top-down drivers (e.g., market size, consumer appetite, etc.) and bottom-up (e.g., unit economics, financing mix, etc.) have to be in place for us to make a bet.

- Regulatory: Governments around the world are updating their food frameworks to adapt to the new wave of technologies coming to the market. Cultured and molecular farming are two technologies where we are skeptical about the pace of regulatory change.

- Consumer adoption: Although we invest in the U.S., our heart is in Europe. We understand the market – and the consumer. We would not invest in GMO products.

- Valuation: Last but not least, the valuations seen in 2021 in the alternative protein sector were out of the ordinary. By looking at the multiples of CPG and food companies in the public markets (e.g. Beyond Meat and Oatly trading at <2x price / sales ratios), and growth rate of alternative protein startups, one can safely conclude that private market valuations did not make sense. As fiduciaries of our LPs’ capital, we have set caps on which valuations we are willing to invest at.

Are these too many factors? Perhaps. But the truth is that there is no checkmark or guidebook to making the best investments in alternative proteins. Different investors will look for different recipes, and get different success results.

Pockets of opportunity

As a thematic and deep dive driven investor, we tend to study areas by exploring academic output, market research or patents, and by connecting with suppliers and buyers (from corporations to supermarkets), consumers (including our own team!), and other stakeholders in the value chain (e.g., CDMOs, plant engineers, regulatory experts, etc.). Because we are not a FoodTech VC, we tend to concentrate our bets within sectors and therefore need to have high conviction about the disruptiveness and growth potential of a technology and company.

In our quest to find the next impact unicorns in alternative proteins, we have defined a few areas of interest that match our criteria. Here we focus on two of them:

1. Dairy precision fermentation

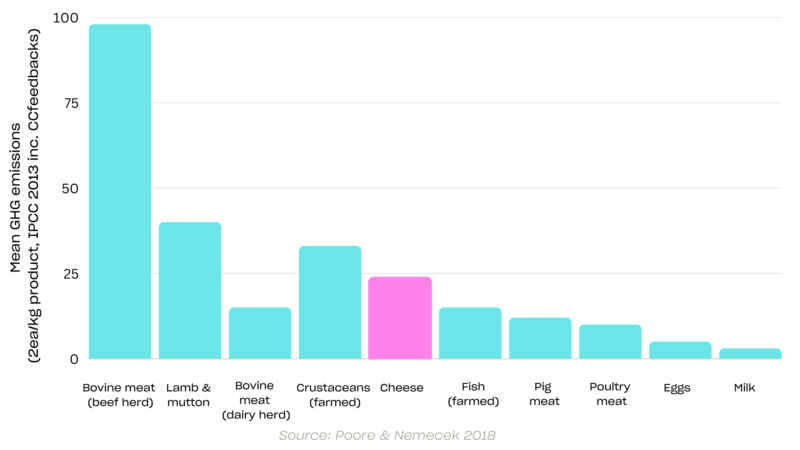

Why animal-free dairy? Dairy is the third largest source of proteins for humans, after plants and meat. According to FAO, the consumption of dairy products is projected to increase driven by higher per-capita income growth projections. From a climate perspective, dairy is not always the top worry of investors. Beef is. However, cheese GHG emissions is among the top from animal proteins, before fish and chicken, at 23 kg CO2e per kg.

There are multiple ways of creating animal-free dairy: through plant-based sources, traditional fermentation, precision fermentation, cultures or even molecular farming. When comparing the different methods, it’s necessary to take a closer look into which one would achieve price parity in the most efficient way (from a CAPEX perspective) and with the highest product quality.

For us, such technology is precision fermentation. Precision fermentation refers to a biotech process that produces bio-identical dairy proteins like casein or whey, without the use of animals. However, precision fermentation is expensive and hard to scale. There are well known development cycles that startups have to follow in order to scale (from lab to pilot to commercial). Further, the CAPEX spending needed to build bioreactors that can produce the same amount of protein tons as with conventional cheese is enormous. Added to that, the cost per kg to produce casein or whey is years away from animal-derived molecules.

Most of the dairy molecules startups are working on are or will become commodities. This makes the investing case more challenging – no investor wants to invest in a commodity game with low product value and squeezed margins (animal-derived casein is at +$15/kg in the market). Finding the right business model, with the right level of IP and differentiation, is key to becoming a successful VC case. The two most well known companies in this space are Perfect Day (B2C and B2B whey products) and Formo (B2C casein products).

2. Functional ingredient platforms

If we look at the barriers to further adoption of plant-based meat, taste, texture and nutritional value are clearly among the top challenges. These can only be solved by upgrading current plant-based products with new ingredients. Only 10% of the ingredients in plant-based products can make all the difference: ingredients such as aminoacids, fats, or egg white replacements.

From an impact perspective, it’s difficult to quantify the impact of ingredients for several reasons: (1) we consider ingredients as enablers of an accelerated penetration of alternative proteins, which is a key additionality factor of our impact guidelines and (2) it is difficult to attribute such acceleration to one single ingredient or factor. However, what we do know (from direct conversations) is that many ingredient companies, from Givaudan to DSM, are looking for the next generation of high-value functional ingredients.

From a commercial perspective, ingredients might be – but don’t have to be – commodities. The most promising combination is a technology platform with multiple functional ingredients that are high-value and difficult to replicate. If the platform has applications beyond food, such as cosmetics or biomaterials, the market size is even more appealing.

Some startups in the space include Shiru (precision fermentation), Arkeon (gas fermentation) and Melt&Marble (precision fermentation). We recommend reading through the fats blog post of PeakBridge VC.

Key Takeaways

- Behavioral change is the largest untapped potential in the fight against climate change.

- Switching to plant-based diets is a prime example of this. But we need the policies, infrastructure and technology in place to enable this change.

- Despite VC investment slowing down, the rate of innovation is only picking up steam now.

- A new generation of ingredients powered by novel technologies like precision fermentation or synthetic biology will help tackle the parity challenge of health, taste and affordability and drive consumer adoption towards alternative proteins.

- Technologies like precision fermentation have an enormous potential but more funding is needed to help upscale and prove economies of scale.

Like our content? Subscribe to our newsletter here!