Our Impact Process Part 2: The Investment Process

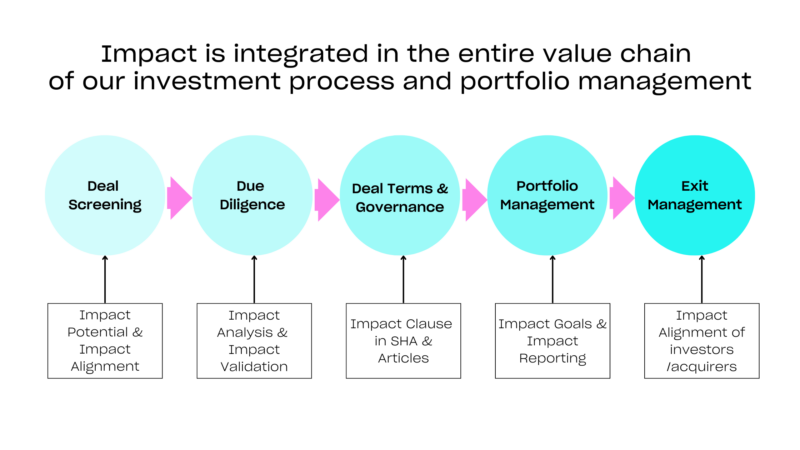

If you read Part 1 of this blog and you are now here – congratulations! That might mean you meet our impact criteria and guidelines. If you also meet our commercial criteria, then you will move to the next stage of our integrated (impact + commercial) investment process. Below you will find a snapshot of what this investment process looks like. (If you haven’t read Part 1 which can be found here, we suggest you read it first).

Our Impact Analysis 6 Key areas

When we are evaluating a startup for investment, the AENU team conducts impact analysis. This analysis consists of six areas (Research, Sizing, Units, Projections, Risks and ESG). Most of the information and data needed to conduct our analysis is either publicly available or part of the operational documentation of a company. We strive to minimize the time spent by startups in our diligence process and therefore offer our support here.

To help explain our impact analysis, we will use an example (dummy) company and apply it to each section of our analysis. Let’s take a plant-based alternative proteins startup.

Impact Research

We leverage resources and methodologies that are based on the latest science available, and supplement those with our in-house research. We evaluate the following: academic research, Paris goals alignment (supported by IPCC research) and EU taxonomy alignment (substantial contribution to climate mitigation and adaptation, do not harm criteria).

Our example: Plant-based proteins contribute to EU Taxonomy objectives of Climate Change Mitigation and Adaptation. According to the IPCC, alternative proteins could avoid around 8 Gt of CO2e (or 800 Mt CO2e) annually should all meat-derived proteins be substituted with alternative proteins (vegan diet).

Impact Sizing

We calculate (top-down) the impact potential of a specific technology (not a company) when deployed at scale. A ‘technology’ is, for example, alternative proteins or carbon removal. The impact potential of these technologies has to be at or above our impact investment thresholds listed previously. This is easy to calculate for hardware technologies or physical goods.

However, software technologies are a bit more tricky. We consider two types of software technologies for investment: first, technologies that are linked to an economic activity (e.g. software that optimizes renewable energy output of wind farms), or technologies that accelerate the adoption of climate solutions or are key components of climate infrastructure (e.g API infrastructure for the scaling of carbon credit markets). These two types of enabling tech should come hand in hand with enabling CO2e or other ways of validating the impact thesis, for example by meeting all of our impact guidelines.

Our example: Although the IPCC reports that alternative proteins could avoid around 8 Gt of CO2e annually, this is a technical maximum (not everyone will become vegan). It is more realistic to look at the growth and penetration projections of the alternative protein market. According to BCG, alternative proteins would capture 11% of the overall protein market by 2035. Therefore, it is expected that alternative proteins could avoid 880 Mt CO2e annually by 2035. 880 Mt CO2e passes our internal impact investment threshold of 100 Mt CO2e.

Impact Units

We welcome companies that have performed Lifecycle Assessments of their products, or that have identified other impact units, attached to both impact and operational KPIs.

Our example: Although no LCA has been conducted, a plant-based alternative protein company might leverage existing research and LCA proxies. For example, Blue Horizon’s 2020 Environmental Impacts Of Animal and Plant-Based Food report has aggregated impact data for alternative protein products.

Impact Projections

At AENU, we create simple impact models that help us understand (bottom-up) the impact potential of a specific company. We apply the Emissions Reduction Potential methodology developed by the Prime Coalition when appropriate.

Our example: By calculating CO2 emissions reduction per kg of product compared to total kg of meat equivalent sold (difference between status quo vs. new product), we project over 150 Mt of CO2e saved by 2030.

Impact Risk

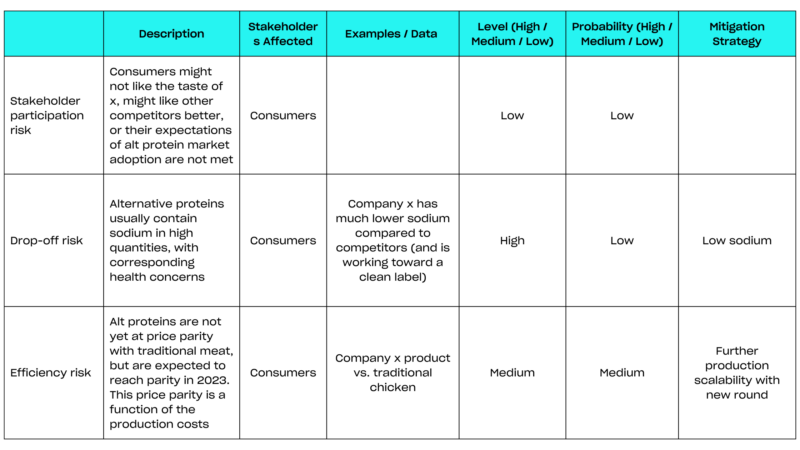

We identify and evaluate top impact risks and externalities for each technology and company. We use the 9 impact risks framework from the Impact Management Project: evidence risk, external risk, stakeholder participation risk, drop-off risk, efficiency risk, execution risk, alignment risk, endurance risk, unexpected impact risk and the above impact potential.

Our example: Below is a snapshot of some of the Impact Risks we would identify:

ESG

Environmental, social, and governance factors (internal impact) is as important as product (external) impact to ensure long-term value creation. Depending on the size of the company, we evaluate the strategy, processes and practices, with a special focus on material ESG factors. We combine this with Principle Adverse Impact from the SFDR framework. We use our analysis to identify strengths and weaknesses, benchmark with portfolio companies and industry standards, and identify opportunities to support portfolio companies (i.e. policy templates, consultants, best practices).

Our example: We would ask our example company: Who has overall responsibility and oversight for ESG? Does the company have any processes or systems in place to identify and manage ESG risks and opportunities, including those associated with its supply chain? What was your company’s GHG emissions for the last reporting year? What is the current gender pay-gap?

Impact Value Creation & Standards

As an impact investor we are in this impact journey together with our startups and therefore see it as a crucial part of our value creation. We have an Impact & ESG knowledge hub and offer impact onboarding sessions to support our startups as best as we can when it comes to theory of change, impact strategy and KPI setting, as well as other topics like ESG, Materiality or B-Corp. Thanks to our network we can refer startups to discounted memberships / subscriptions, consultants, carbon software accounting platforms, and other partners.

“Since partnering with AENU, the team has strongly supported us at EDURINO mainly in two areas: Firstly, in defining our impact strategy and associated KPIs, and secondly, in making highly relevant introductions into the industry and to potential partners.”

– Franziska Meyer, co-founder EDURINO

Key takeaways

It is important to understand what we (or any other impact investor) is looking for, so you don’t waste any time with applications on cold / soft outreach. When applying for AENU investment, first check that your startup meets our impact thresholds and guidelines. Then gain an understanding of what to expect in the screening process and once you speak with us, ask what to expect from us (or any other impact investor) in terms of support going forward. The more prepared you are, the smoother the process and the more impact you can make with your chosen investor.

To discover more about our impact methodology and process download our Impact Framework and check out other Impact Resources.

Like our content? Subscribe to our newsletter here! We won’t bombard you, we send our newsletters out every few months with content we believe will be rich and useful for our community.