Tech

We look for companies that have proprietary technology with a high degree of defensibility at the core of its DNA. We invest across software and hardware.

We look for companies that have proprietary technology with a high degree of defensibility at the core of its DNA. We invest across software and hardware.

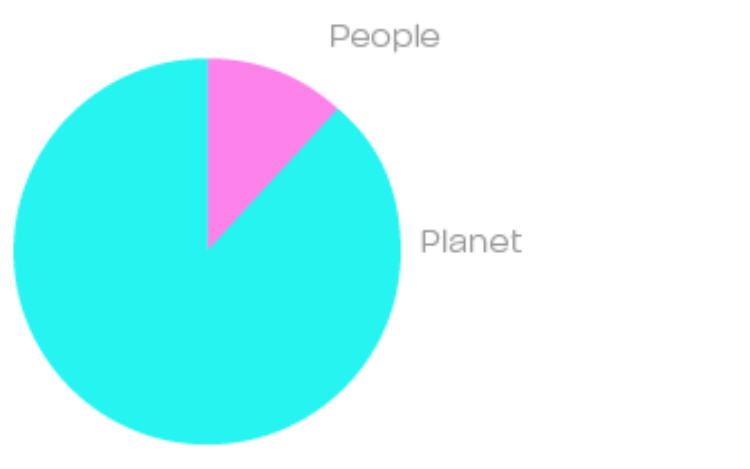

The climate or social impact must be intentional, measurable, net positive, interlocked and capable of reaching a meaningful scope relative to the problem being addressed.

More detail here.

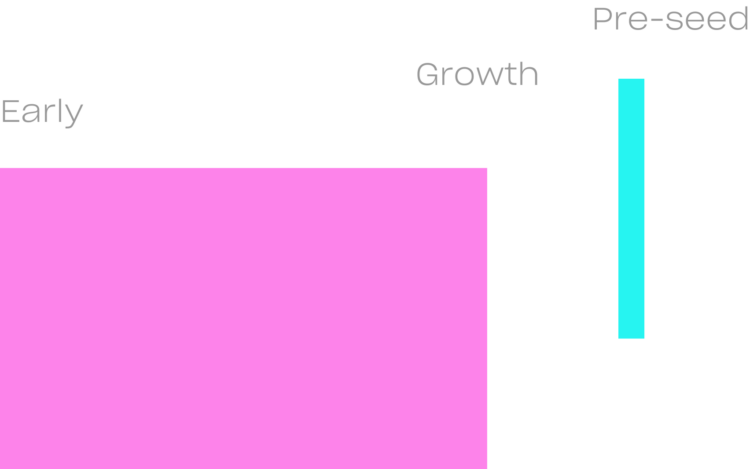

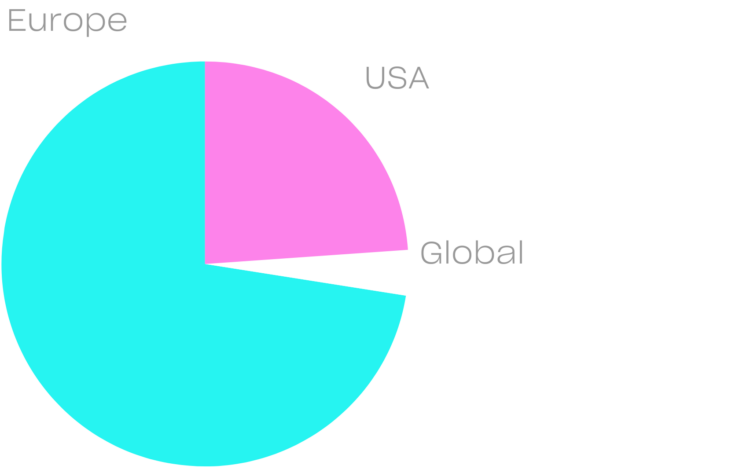

We invest with a focus on early stage in Europe, mostly leading and co-leading in Seed and Series A rounds. Initial checks range from €500k up to €5M with follow-on up to €10M.

We have an active approach towards portfolio value-creation in four key areas, supported by our proprietary AENU resource hub:

Our portfolio companies by current stage of maturity.

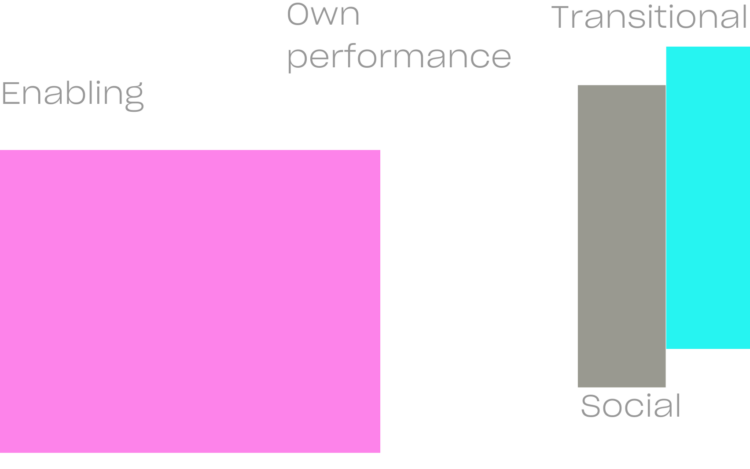

A breakdown of impact-category addressed by companies.

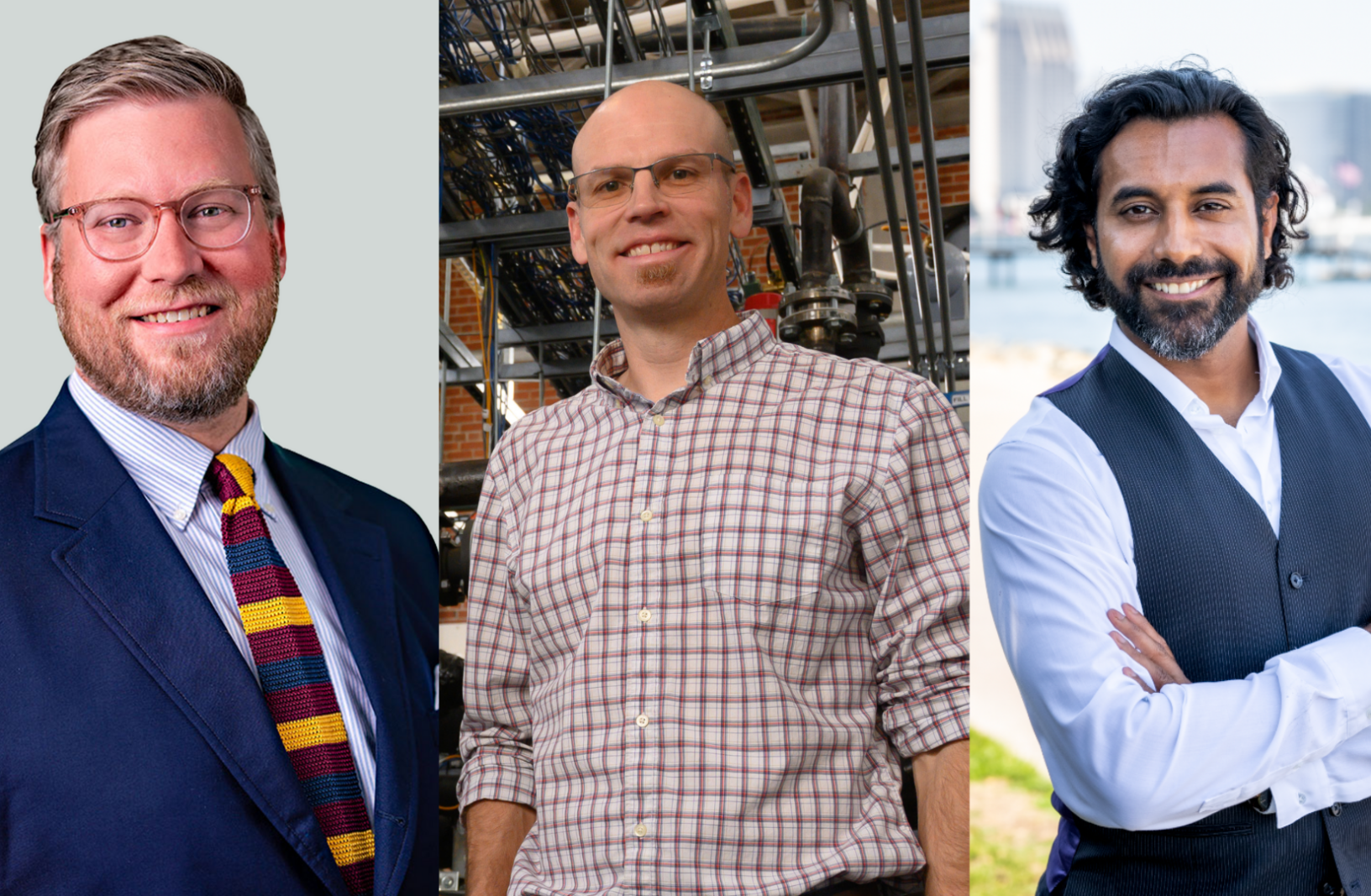

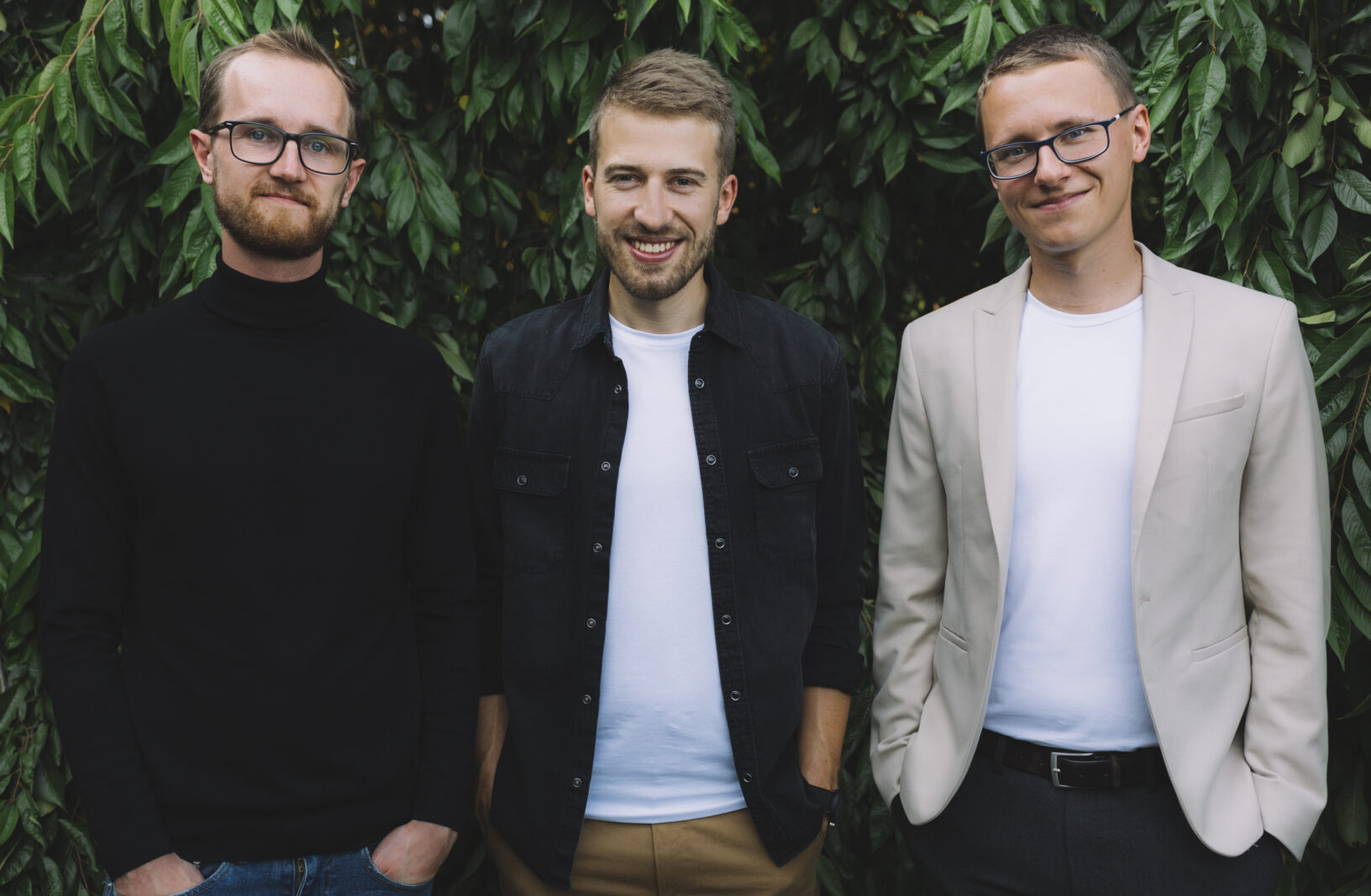

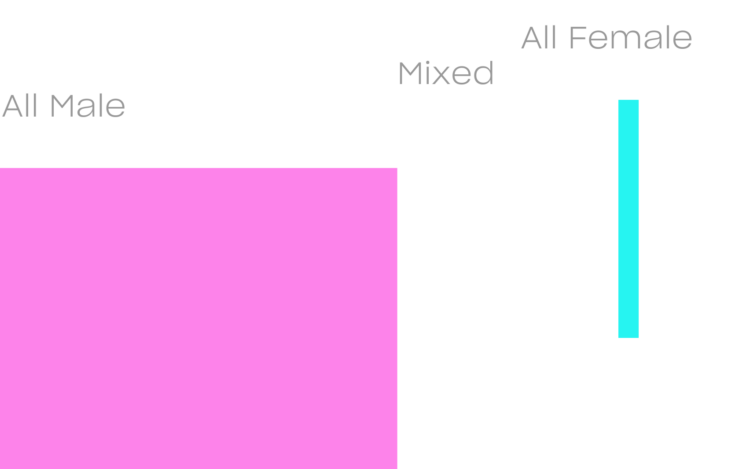

Composition of the founders and senior management teams of our companies.

By location of our company’s headquarters.

Portfolio break-down according to EU-Taxonomy categories.

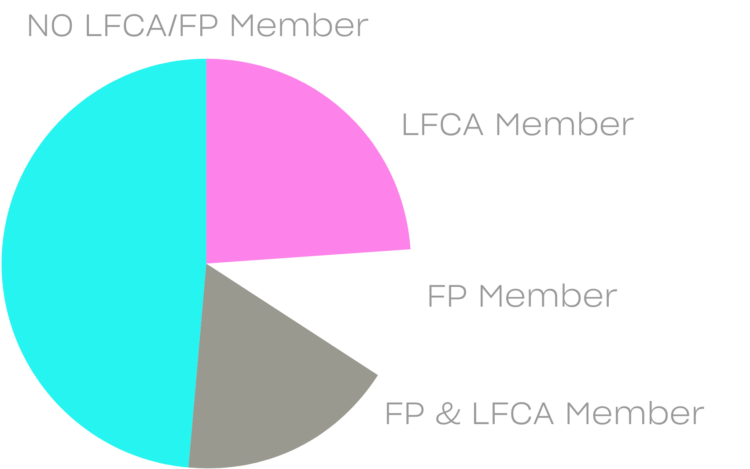

Memberships of our companies at Founder’s Pledge and LFCA (Leaders for Climate Action).