Why we invested in Metris Energy

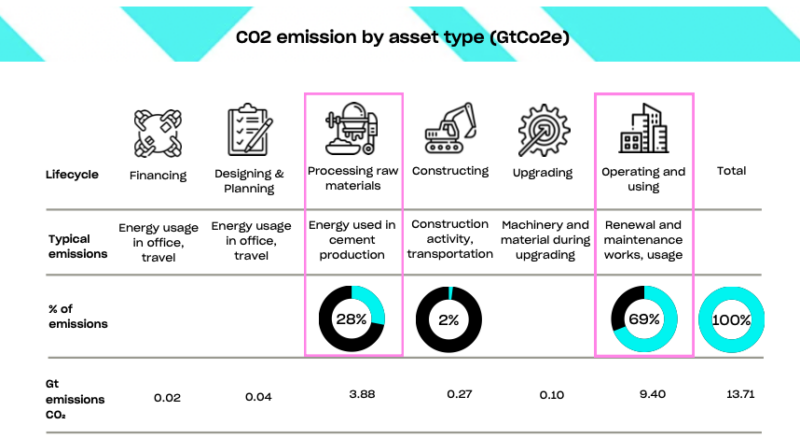

The buildings and construction sector accounted for over 34% of energy demand and around 37% of energy and process-related CO2 emissions in 2021. Within the buildings segment, operations and use are the largest emission drivers.

The main impact lever is increasing the energy efficiency of the existing building stock by (i) retrofitting buildings with more energy-efficient hardware solutions and (ii) optimising energy flows of new and old energy systems. In the residential housing market we have seen solutions deploying and operating distributed energy resources (DERs) such as our portfolio companies Hometree and Zolar. On the commercial side however the return profile of solar PV remains opaque and therefore creates a split incentive problem. The commercial property owner must invest to install solar whilst the tenant(s) benefit from cheap and green energy. Additionally the installation in itself, its financing and operations remains complex. These challenges have hindered commercial property owners from unlocking the solar potential within their portfolios.

Metris Energy’s vertical tech-first solution solves the split incentive problem and significantly lowers the hurdles of solar adoption. Metris offers a comprehensive solution that simplifies the solar energy transition for commercial property owners, guiding them through every stage, from the initial assessment and financing to installation and continuous management. Once the panels are in place, Metris facilitates property owners in capitalising on their solar investments by digitally transforming and automating contracts for selling solar energy back to tenants. Metris creates a passive income stream for property owners and increases the property’s value. By helping property owners unlock the solar potential in their portfolio, Metris Energy operates in a £22bn market opportunity and has the potential to contribute to avoiding 14M tonnes of CO2.

The founding team behind Metris Energy was a significant reason for our investment. At AENU we have known CEO Natasha for a few years during her time as an investor at Octopus Ventures. Her experience as an algo-trader at Credit Suisse and an academic background focusing on Public Policy with published research on socio-economic factors influencing solar adoption creates a great founder-product-market fit. Natasha teamed up with Will who leads Metris’ tech development. Will has extensive experience in various startups as a fractional CTO, bringing ideas from 0 to 1 as well as building and managing diverse tech teams. His experience in ML-based remote monitoring combined with a very product and design driven mindset makes him the ideal CTO to create a 10x better tech product.

We are excited to co-lead Metris Energy’s $2.3M Pre-Seed financing round alongside Octopus Ventures who have extensive knowledge in the UK energy market.

Read the full press release here.