5 lessons learnt from implementing an ‘E’ clause with portfolio companies

Signing an impact & ESG clause with our portfolio companies is a no brainer for AENU. As an impact tech VC fund, we want to be as aligned as possible with our founders both on commercial and impact matters. Given the type of companies we want to partner with — we look for intentional founders who are building impact interlocked businesses — I never thought anyone would say ‘no’ to signing such a clause. Naive me.

Initially, our ‘E’ clause consisted of 4 key points: (1) committing to achieving net zero by 2030, (2) designing an emissions reduction strategy, (3) measuring scope 1, 2 and 3, and (4) compensating residual emissions with high-quality carbon removal and / or avoidance offsets. At face value, we considered these 4 points as the minimum common denominator for climate-aligned businesses. After all, who doesn’t want to reach net zero? Yet, we quickly realized that our assumptions were wrong. Below are the top 5 bottlenecks we had to navigate.

1. Lack of internal accountability

Accountability can make or break progress in impact & ESG commitments. Successful accountability starts with ensuring that all parties are on the same page about the goal, and ends when decision-makers have marked it as complete. Given resource and time constraints, some of the early-stage startups we were in negotiations with didn’t feel they had enough internal resources or capabilities to deliver on the ‘E’ clause. After several feedback loops, we identified the following best practices:

- Include the ‘E’ clause in the legal documentation (e.g., shareholders’ agreement), and not just in the term sheet (bonus: show a united front with other cap table investors!)

- Assign roles & responsibilities in sustainability. Even if an early-stage startup doesn’t have the resources to hire a dedicated FTE, it might opt to assign an FTE fraction to a current employee or to an internal sustainability committee.

- Ensure that the ‘E’ goals are agreed and regularly reviewed by the board of directors on an annual basis, at minimum.

2. Avoid ‘one-fits-all’

Venture capital and entrepreneurship is an efficiency and execution game. But as an impact tech VC, we are adding more complexity to every process, even if the outcome is necessarily better. When we drafted our first impact & ESG clause, and given the breadth of companies we partner with — from social to climate impact, early to growth stage –, we took the approach of being true to our impact mission, and therefore, exhaustive. The ‘E’ clause was 2 full pages long, and a mix of conceptual and prescriptive commitments.

The earlier the startup, the more difficult the conversation on the ‘E’ clause was. Lack of resources for carbon accounting or lack of time to create a climate strategy were some of the top reservations. In the end, an entrepreneur has to regularly make trade-offs. Why would a founder invest in a climate strategy when investors are expecting her to find product-market fit as soon as possible.

Our initial long clause was slowly transformed into two clauses that reflected more closely our ESG maturity assessment. We asked ourselves: what are we realistically expecting of early-stage startups vs. growth stage startups? What are the top material factors for a hardware vs software company? Although there will always be founders who will question the length or content of the clause, we believe we have found an ‘E’ clause-founder fit.

3. Tailor measurement expectations to stage

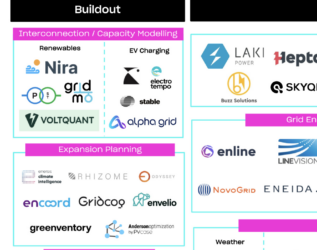

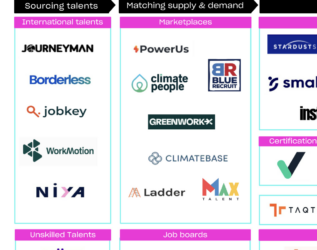

Alongside having a shorter ‘E’ term sheet for early-stage startups, we also had to think about what’s a feasible and appropriate emissions measurement system. By now, there are a myriad of options in the market: from hands-on consultants to sophisticated carbon accounting software tools. Early-stage especially startups struggle with where to start.

Hardware cases aside — as an impact tech VC we prefer life-cycle assessments that prove a technology is climate positive — we recommend early-stage startups to start small. For example, Leaders for Climate Action (LFCA) has a free online emissions calculator tool that is a perfect starting point for understanding a company’s emissions breakdown as well as biggest change levers. As the company grows, and its internal capabilities and resources grow alongside it, we expect growth-stage startups to use full carbon accounting tools, such as Minimum or Normative, or specialized consultants. Some VCs opt to provide free carbon accounting licenses — usually for one or two years — to their portfolio companies.

4. Implementation support is key

Beyond deciding on a measurement system, creating a thought-through climate strategy is critical. Without creating a climate strategy roadmap — the why, what, who and when — a startup might fail to fulfill its commitments. AENU is in the lucky position to have an impact team that startups can rely on for value-add. More and more generalist funds are also adding sustainability team members.

When working with our portfolio companies, we realized there are a few impactful ways we can support them in their climate journey:

- Share our own climate roadmap, in the form of a strategy template

- Provide examples of climate policies and initiatives carried out by us or by other portfolio companies

- Connect them with other portfolio companies or startups in the ecosystem that are going through the same process to share insights and learnings

- Have a contact person within the fund that can provide tips and feedback, and can act as the ‘go-to’ person for sustainability topics

5. Follow up on progress

The last step in the accountability process is making sure that the right information is flowing from founder to investor. What information is reported on, in which format, and how it is analyzed and acted upon is as important as all the above points.

In Europe, SFDR does most of the work for us. The regulation asks investors to collect and report on specific ESG metrics from portfolio companies on a regular basis, many of which are climate-focused. Although the regulation is a vast piece of work, with many exceptions and caveats, it is a minimum common denominator for venture funds — impact or generalists.

At AENU, we use Apiday to collect quarterly ESG and impact data from our core portfolio, as per SFDR. For us, reporting is a tool for action. We use the collected data to understand strengths and gaps in our companies’ sustainability strategies, and to tailor value-add support. As our companies grow in size, they will face stricter regulatory requirements. Setting them up for success is our priority #1.

***

Although AENU has gone a long way since its first impact & ESG term sheet, we keep getting feedback and iterating on our processes. As new challenges arise, we strive to be constructive with our founders and keep sharing our learnings with the ecosystem.